Kazi Capital connects investors to vetted opportunities targeting high annual returns.

We identify and evaluate high-performing private equity, commercial real estate, and energy opportunities using rigorous market research and expert due diligence.

We negotiate and secure institutional-grade deals directly with top-tier operators and private equity firms.

We actively manage investments to maximize income, growth, and long-term value for our partners.

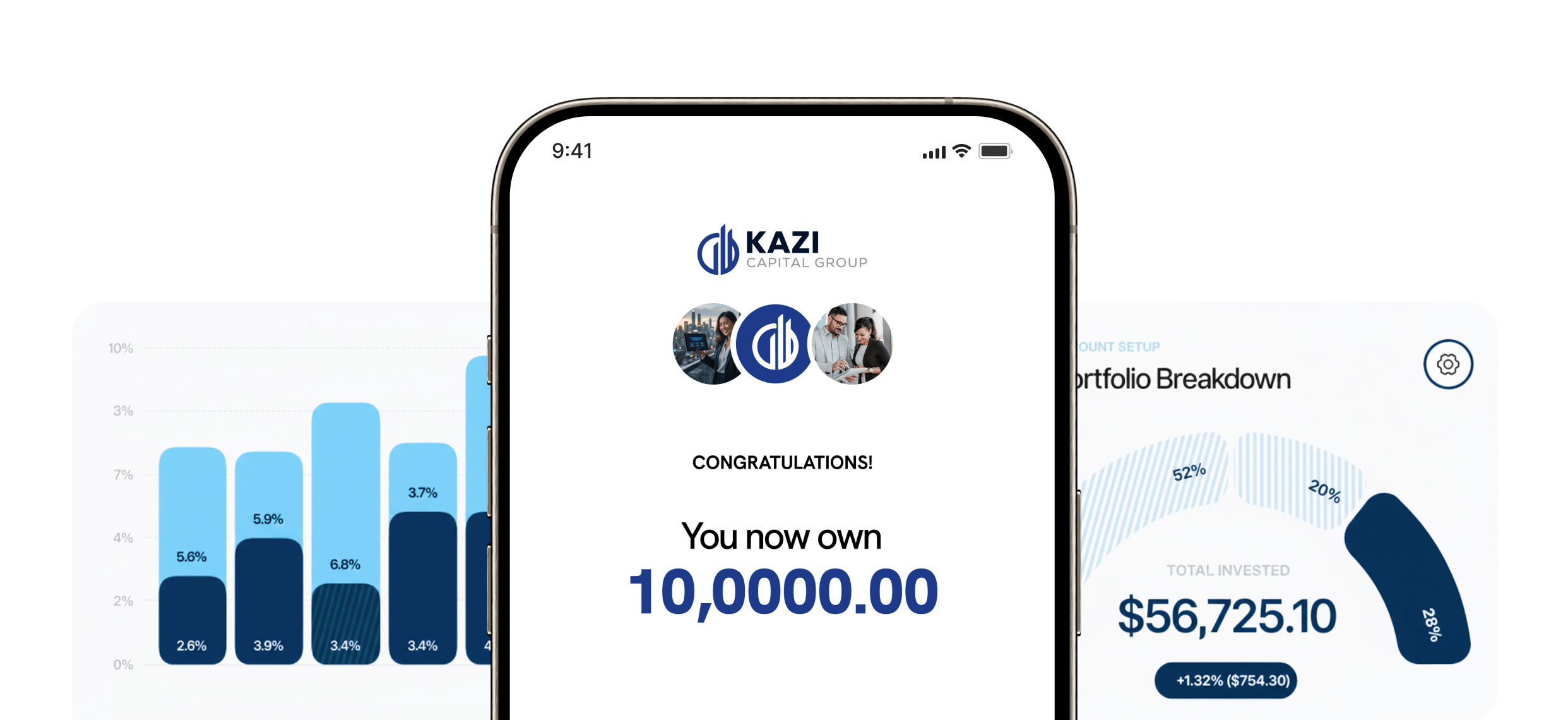

We provide transparent, timely returns, delivering income directly to our investors while maintaining clear reporting and oversight.